Children are full of questions. They wonder why the ground shakes, what causes mountains to rise, and how the Earth changes shape. These big questions are perfect entry points for natural science in a Montessori setting. Introducing earthquakes to young learners isn’t about causing fear—it’s about showing them the power […]

Read More

Facts to Spark Curiosity in Young Learners

Children are natural question-askers. They wonder how birds fly, why the moon changes shape, or what ants carry back to their nests. In a Montessori environment, this curiosity is not just welcomed—it’s essential. Whether it’s exploring the wonders of nature or diving into USA facts that broaden their worldview, children […]

Read More

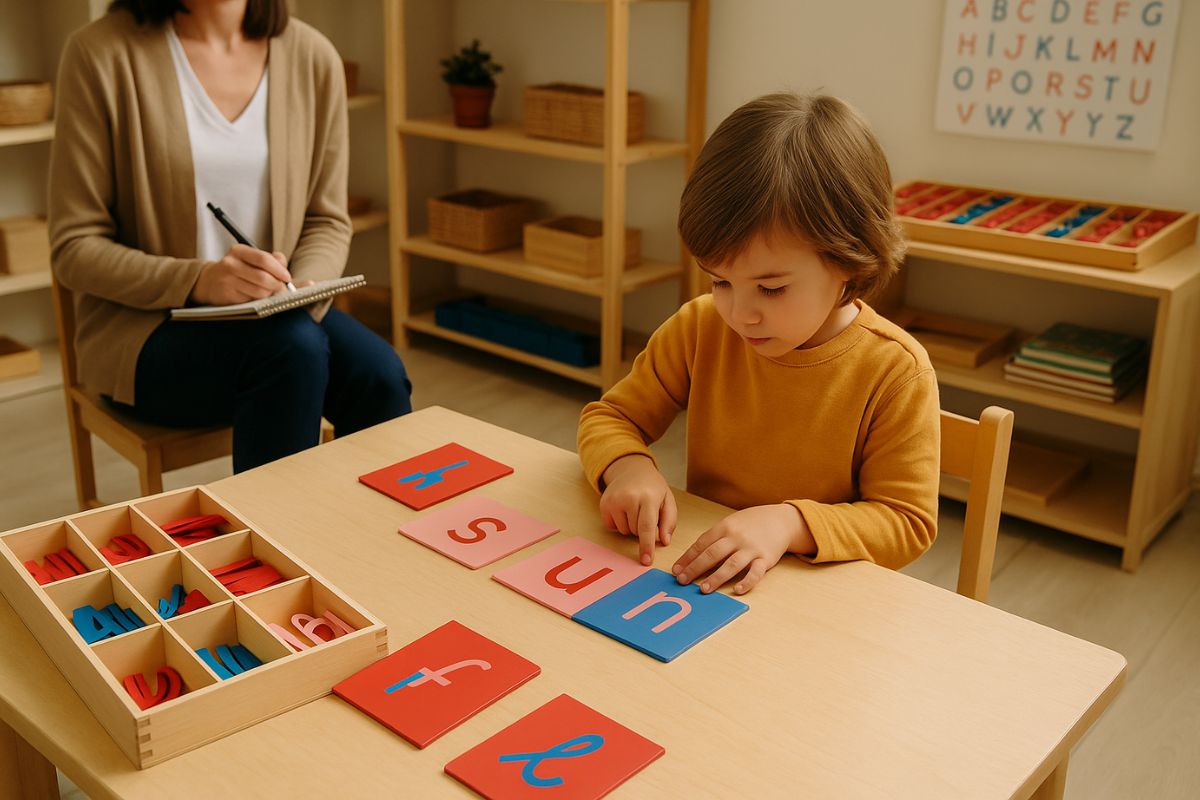

A Research-Based Look at Montessori’s Approach to Literacy

Children don’t start reading just by memorizing letters. They build language from the ground up—by listening, moving, speaking, and touching. The Montessori method understands this. It doesn’t rush the process. Instead, it carefully prepares the child’s environment and experiences, so reading and writing grow naturally, with joy and confidence. For […]

Read More

Creative Language Play with Random Words

Children absorb language with a sense of wonder. They don’t just learn vocabulary—they invent, imagine, and twist words in playful ways. In a Montessori environment, this natural tendency toward language exploration is respected and encouraged. When children are given space to play with language, even through random or silly word […]

Read More

How Montessori Encourages a Growth Mindset

Children are natural learners. They explore, question, and try again when things don’t work the first time. This drive is not about competition. It’s about curiosity and effort. In a Montessori setting, this instinct is protected and supported—leading children to believe they can grow their abilities through experience, reflection, and […]

Read More

How to Introduce Practical Life Activities in Montessori

Young children want to do what adults do. They watch closely, copy movements, and try to take part in everyday life. In the Montessori approach, this natural interest is supported through a key area of the classroom called Practical Life. These activities help children learn independence, care for their environment, […]

Read More

The Role of Movement in Early Learning According to Montessori

Children learn through their whole bodies. Long before they speak in full sentences or grasp complex ideas, they are reaching, crawling, touching, and moving their way through the world. Dr. Maria Montessori recognized that this physical activity was not a distraction from learning—it was the foundation of it. In Montessori […]

Read More

Visual Symbols for Early Learning Environments

In a classroom full of movement and questions, not every child will respond best to verbal instructions. For many young learners, especially those still developing language or navigating new routines, visual symbols offer clarity, comfort, and independence. These simple tools—icons like smiley, images, or color cues—can make a big difference […]

Read More

The Role of Independence in Montessori Education

Step into a Montessori classroom, and one of the first things you’ll notice is the quiet confidence of the children. They’re not waiting for instructions. They’re not lined up for the next activity. Instead, they’re choosing their own work, moving freely, and engaging deeply—all without needing constant adult direction. This […]

Read More

Overview of Certifications and Programs for Aspiring Montessori Educators

Choosing to become a Montessori educator is more than a career move. It’s a calling to nurture curiosity, independence, and lifelong learning in children. But before stepping into the classroom, many aspiring educators find themselves overwhelmed by one big question—how do you get trained? Montessori teaching is not just about […]

Read More